Linear Finance operates as a decentralized finance (DeFi) platform Its main objective is to seamlessly merge traditional assets with cryptocurrency, providing an improved experience marked by enhanced scalability and faster transaction speed. Leveraging smart contracts and oracles, Linear Finance ensures transparency, security, and the effective management of synthetic assets within the decentralized finance (DeFi) landscape.

Linear Finance functions as a delta-one asset protocol operating on the Ethereum network, empowering users to create, manage, and trade synthetic assets representing real-world financial instruments. Through the conversion of ERC20 and BEP20 tokens which are digital representations of real-world assets such as stocks, commodities, or fiat currencies, into synthetic assets. It also facilitates simple trading across both the Ethereum and Binance Smart Chain platforms.

A diverse array of fixed-asset products available for trading on a decentralized exchange (DEX). The overarching mission of Linear Finance is to leverage the capabilities of blockchain technology to facilitate efficient and transparent financial management. This is achieved through the implementation of smart contracts, claims, staking mechanisms, and governance structures on the platform.

Here is a comprehensive explanation of how Linear Finance works:

Asset Tokenization

One pivotal aspect of Linear Finance’s operations is the process of “asset tokenization,” that allows users to create synthetic assets by depositing collateral in the form of cryptocurrencies.

Wherein the underlying asset is pledged as collateral, and in return, LTokens are issued. For instance, if a user wishes to create an LUSD token tracking the value of USD, they must deposit USD as collateral to receive LUSD in exchange.

It plays a crucial role within the Linear Finance framework, granting users access to a diverse range of synthetic assets that derive their value from real-world assets without ownership. This unique and innovative approach allows users to participate in markets for assets like gold, oil, and stocks without the need to physically acquire and hold these assets.

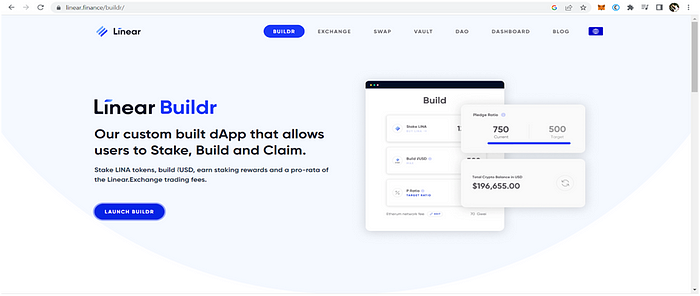

Collateralization

Users who wish to mint synthetic assets need to provide collateral in the form of Linear Tokens (LINA), which is the native token of the Linear Finance . The collateral ensures that the value of the synthetic asset is fully backed.

LINA is the native utility token of the Linear Finance platform. It serves various purposes within the ecosystem, including governance, staking, and collateral for minting synthetic assets.

Oracle Integration

Linear Finance integrates with external price oracles to provide real-time price feeds for the underlying assets. These oracles play a crucial role in establishing the value and price fluctuations of synthetic assets by relying on the real-world assets they represent.

Price Feeds

The pricing of LTokens is determined by an oracle delivering real-time price data for the underlying assets, guaranteeing that the value of LToken consistently mirrors that of the underlying asset. Oracles play a vital role in any blockchain-centric platform dependent on external data or alternative sources.

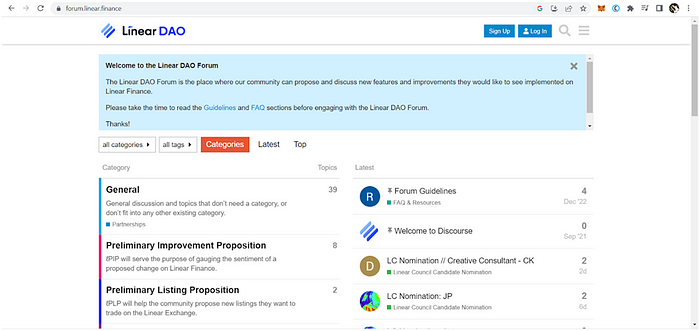

Within the framework of linear finance, trustworthy third-party oracles are chosen through a community voting mechanism to provide value feeds. This safeguards the accuracy, precision, and reliability of pricing, as the community is deeply invested in upholding the platform’s integrity and transparency.

Liquidity Provision/ Liquidity Pools

It utilizes liquidity pools to facilitate the trading of synthetic assets. Users can provide liquidity to these pools by depositing their tokens and earning rewards (Liquidity Provider tokens) in the form of transaction fees and other incentives.

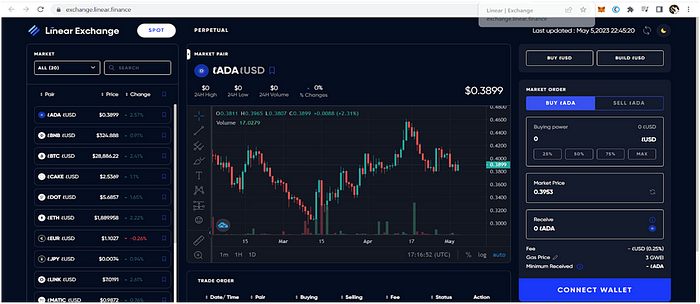

Trading

Trading these tokens is facilitated on decentralized exchanges such as UniSwap v3, SushiSwap, Curve, and others. Furthermore, users have the flexibility to engage in the buying and selling of Linear Tokens using alternative cryptocurrencies or stablecoins. This implies that users can actively trade a diverse array of assets on the platform, free from concerns about traditional entry barriers like legal restrictions or exorbitant fees.

Decentralized exchanges play a pivotal role in the decentralized finance (DeFi) ecosystem by eliminating intermediaries like banks or brokers. This transformation makes trading faster, more cost-effective, and more convenient for a broader audience than was previously possible.

The Future of Linear Finance

Linear Finance, though relatively recent in the blockchain landscape, has garnered significant attention from the Decentralized Finance (DeFi) community. As more individuals recognize the potential of blockchain technology, platforms like Linear Finance are poised to play an increasingly crucial role in the future of finance.

A key advantage of Linear Finance is its provision of user access to a diverse array of assets tradable on a decentralized exchange or DEX. This empowers users to engage in trading specific assets without the need for actual ownership, presenting a substantial benefit for investors and those seeking to adjust portfolios or make strategic investments.

Anticipated developments in the realm of Linear Finance include the introduction of new asset products and features, enhancing the platform’s user-friendliness and transparency. Notably, plans are underway to incorporate yield farming and liquidity mining, enticing more users through additional incentives.

In the realm of financial technology, Linear Finance stands out as a dynamic platform with the potential to revolutionize the global financial industry. Harnessing the capabilities of blockchain technology, the platform offers users a transparent, decentralized, and efficient avenue for trading synthetic assets. This is made possible through continuous integration of new products and investments within the Linear Finance ecosystem.